The regulations explained

The regulation for UMR was set in motion at the 2009 G20 meeting following the global financial crisis. It requires firms using over-the-counter derivatives to post margin on those transactions. Phases 1 to 4 have covered firms with $750 billion+ in notional value.

According to International Swaps and Derivatives Association (ISDA) during waves 1-3 of UMR, only some 34 global asset managers come under the scope of UMR. But waves 4 and 5 saw that expand to 1,200 firms, who between them will have some 9,500 counterparty relationships, each of which required new sets of documentation.

For Wave 5&6, the legal aspect of UMR will be several times more complex and generate several times more administrative workload – and not just for back-office staff.

Firms need to:

- set up segregated accounts both for collecting margin and for posting margin.

- new Credit Support Annexes (CSAs) agreeing how they will calculate IM, the eligible collateral, the haircuts, how Non-Transferrable Assets (NTAs) will be broken down, how thresholds will be split, and how they are going to separate regulatory and non-regulatory IM.

Furthermore, not all transactions will be subject to the rules e.g. equity options are out of scope in the US and Singapore, but in scope in Japan, Canada, Australia and Brazil, while there are temporary exclusions on them in the EU, Hong Kong and Korea.

Posting margin is not too complicated but the Standard Initial Margin Model (SIMM) requirements asked for a lot more than just a standard variation margin exchange.

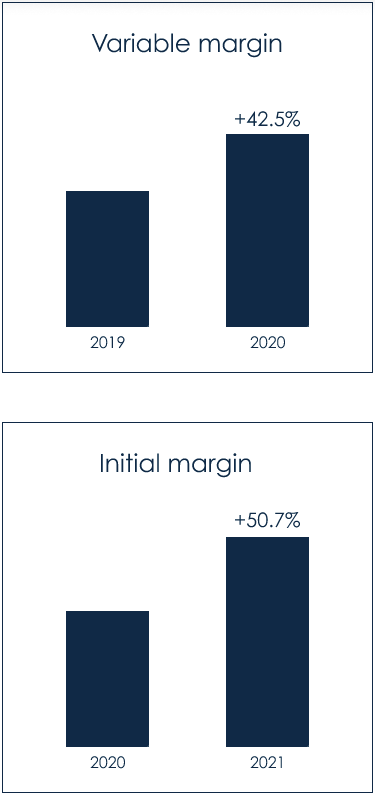

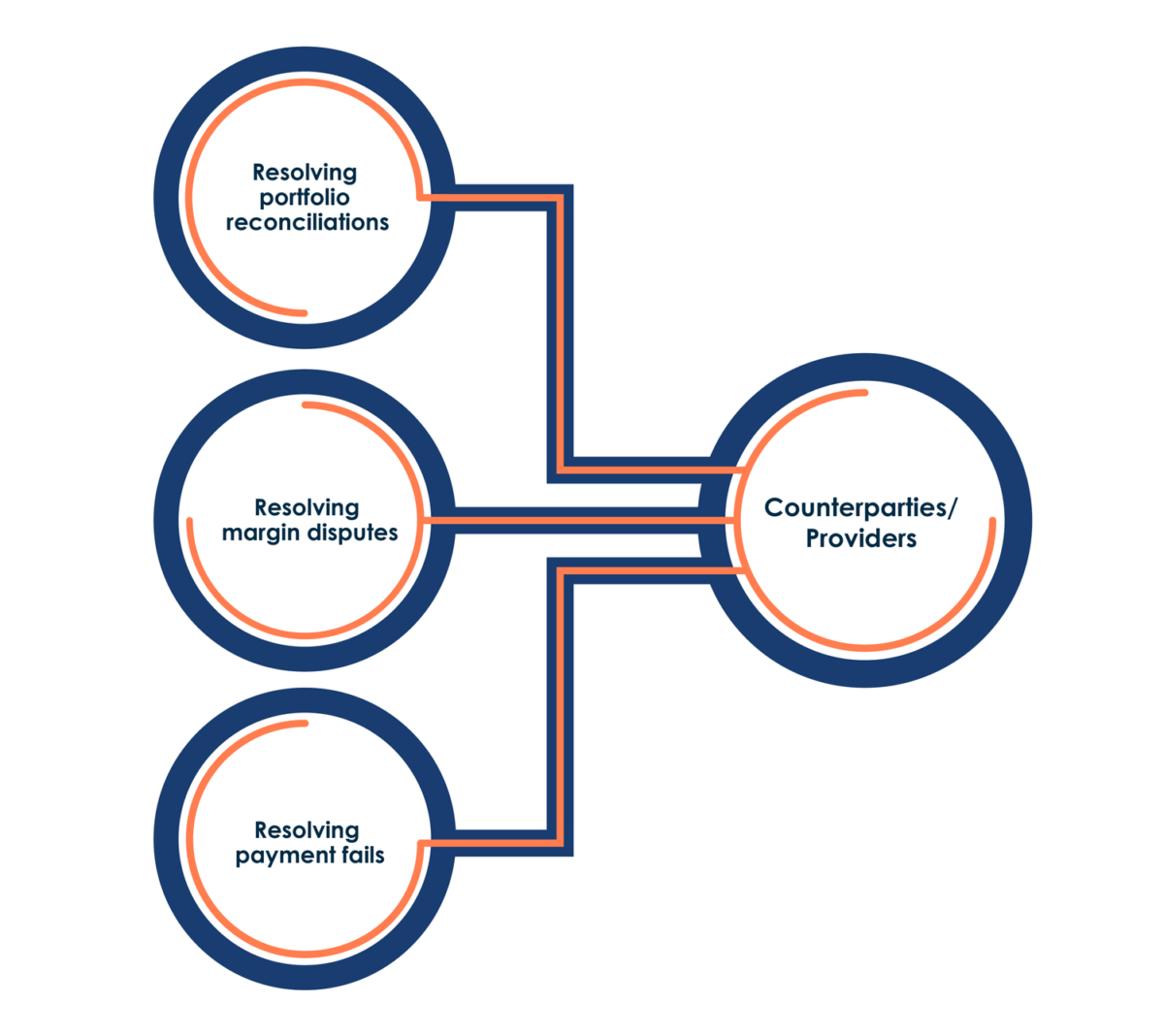

Adhering to, reporting and managing the process requires firms to exchange more margin more often so many more disputes have arisen, which had to be monitored and managed through operations.

The industry is already posting over USD 100 billion of uncleared margin, which is a huge cost to the industry in terms of loss of liquidity. And much of this is posted in the form of segregated assets that cannot be rehypothecated, which in turn is a huge drag for the whole business.

Wave 4 Sept 1 2020 Aggregate Average Notional Amount of non-centrally cleared derivatives (AANA) >750bn

Wave 5 Sept 1st 2021 – AANA > €50bn

Wave 6 Sept 1st 2022 – AANA > €8bn

Download fact sheet Contact us