Preparing for a shorter settlement cycle (T+1)

The global move to T+1 is underway and as the US market moves to a shorter settlement cycle, research shows that currently 81% of US and Canadian brokers and banks still rely on manual processes and legacy inhouse technological systems, which will act as a barrier to a successful migration to T+1.

Firms will need to embrace technology that connects the execution of the trade orders more seamlessly with the post-trade activities required to settle securities transactions. Organisations should utilise processes like STP within the technological stack, but also focus on cohesive connectivity across the participants who facilitate post-trade activities (for example, client service, settlements, and custodians departments).

Despite the benefits of the move to T+1, it will undoubtedly pose many operational challenges around the world which will have far reaching consequences if not managed properly, such as loss of netting benefits and pre-funding. A successful migration to T+1 will require more seamless communication and immediate issue resolution which will involve support from fintech solutions.

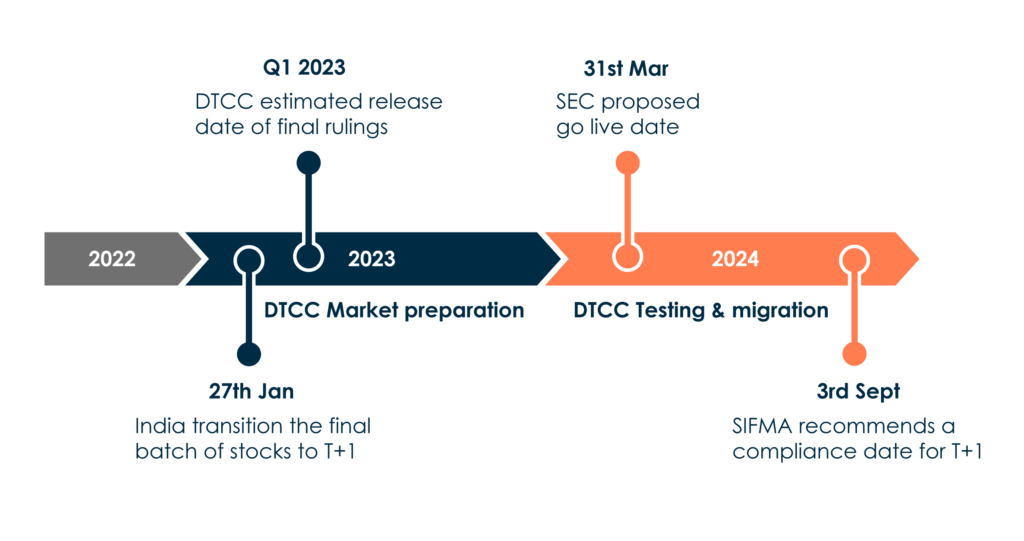

*Timeline subject to change

The solution to post-trade issues

Taskize was purpose-built to resolve post-trade issues faster and more effectively than traditional methods. Our platform connects teams together and seamlessly inviting external counterparties to resolve issues, through direct communication, allowing everyone to share documents and data in real-time.

Taskize has a variety of features to help operations teams around the world prioritise work, avoid missing deadlines and even prevent future issues from arising.

Features designed for you

Taskize Bubble

Taskize Bubbles remove the pain of managing long and complicated email threads. You can keep all relevant messages and documents in one place, so nothing gets lost, and you can keep a clear auditable trail.

Smart Directory

Our unique dynamic matching technology automatically adds the person or people needed to resolve your issue to a Bubble. It will also allocate the most appropriate person based on their role in the business and considers their current workload and availability, to make sure that your issue is resolved as quickly as possible.

Root cause analysis

By tagging the root cause of a dispute as it occurs, you can eliminate the need to manually keep track of the main causes of disputes. Our MI reporting dashboards provide you with data in real-time so you can improve your processes and reduce the risk of future issues.

API integrations

Connect your internal and external platforms with Taskize. Taskize synchronises inter-company workflow through our powerful, yet easy to use API. We’re already integrated with a variety of vendors making it easy to use across departments.

To make sure that Taskize can be fully integrated into your internal workflows, please contact a member of our team who will be happy to discuss your requirements.

The regulation explained

The US Securities and Exchange Commission (SEC) has proposed rules to shorten the standard settlement cycle for most broker to broker-dealer transactions from two business days to one.

In a key difference from the previous move from T+3 to T+2 settlement, the proposed changes would remove the exemption allowing most firm commitment underwritten securities offerings that price after 4:30 pm ET to use a T+3 or T+4 settlement cycle without express agreement. However, the proposal would continue to allow parties to affirmatively agree on a longer settlement cycle at the time of the transaction.

Three key changes:

- Change of Standard settlement date in Rule 15c6-1(a), keeping existing exclusions.

- Removal of the exemption allowing T+4, removing Rule 15c6-1(c)

- Keep the rule 15c6-1(d) exemption substantially the same. Only removing the reference to 15c6-1(c) that allow parties to agree to an alternative settlement date.