Events & Webinars

Taskize recently attended The Network Forum’s Annual Meeting in Warsaw – a global community event for the custody, settlement and post-trade sector.

Taskize recently attended The Network Forum’s Annual Meeting in Warsaw – a global community event for the custody, settlement and post-trade sector to discuss key issues and share best practices – and another opportunity for us to demonstrate the value of the Taskize platform and its integrations with other leading fintechs.

Here’s a recap of the sessions we attended and our key takeaways from each.

AI – What could and should be automated in the securities flow?

This session featured Philippe Laurensy, Managing Director of Taskize’s parent company Euroclear, and Daniel Carpenter, CEO of Meritsoft, amongst others.

Philippe heads up group strategy for the Euroclear entities and has spoken on stage with Taskize about post-trade automation several times. At a recent event, he highlighted how:

“In post-trade, I think Taskize has found a way to streamline the way we manage query resolution in a more efficient manner than using email, phone calls and the like.”

Daniel delved into Meritsoft’s recently-launched Trade Tracking and Exception Manager (TTEM) and its integration with Taskize to enable faster query resolution in a drive to minimise trade settlement fails:

“In the context of T+1 and growing pressure to resolve settlement issues quickly, the integration of Taskize into our trade tracking and exception management system is a significant step in helping market participants to streamline their settlement processes.”

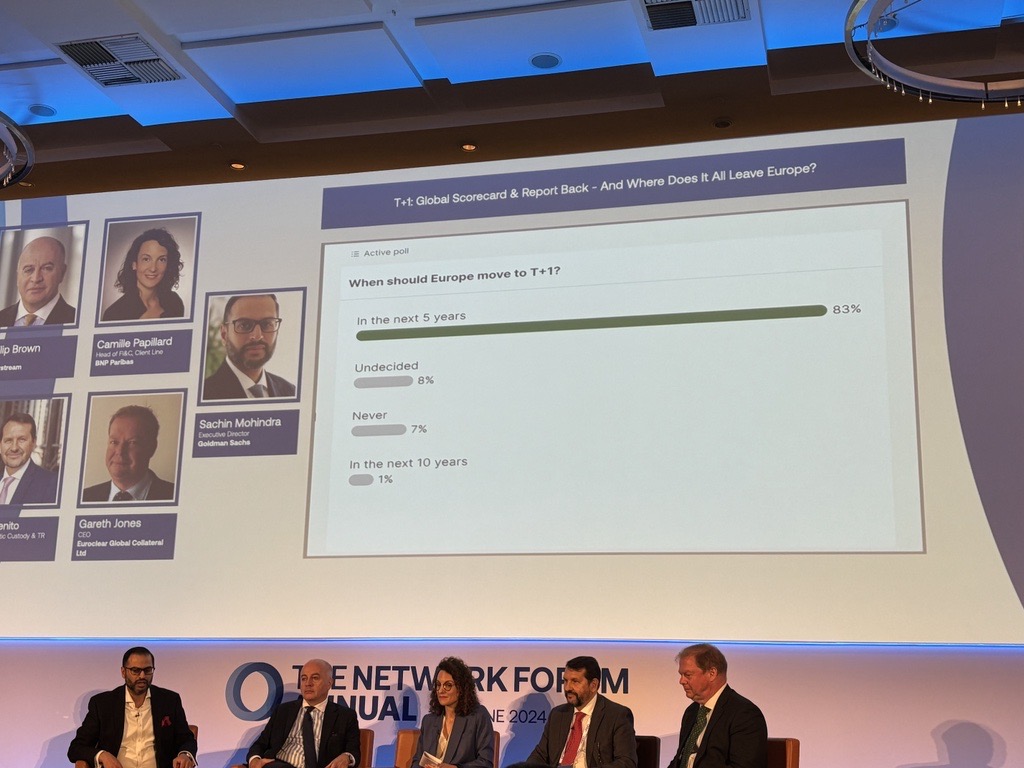

The T+1 session provided a global perspective on the transition to shorter settlement cycles. While the global migration has been smooth, with affirmation rates exceeding expectations (95%), the European market faces unique challenges due to its complexity.

The majority of the audience (83%) said that Europe should move to T+1 in the next five years with ”global alignment” being the main driver.

Emerging markets – Still the growth engine of the world?

Emerging markets, particularly in Asia, the Middle East, and Eastern Europe, were highlighted as key growth areas despite underperforming global markets by 40%. Asia, driven by strong domestic and global demand, shows resilience despite the impact of fluctuating interest rates.

The audience agreed that political changes remain the biggest investment risk, with initiatives like DORA (Digital Operational Resilience Act) in Eastern Europe being important for future growth.

The general clearing initiative in UAE coming later this year will be crucial for the broker-dealer community but this needs to happen in three or four markets for it to have a real impact.

And lastly, the various settlement cycles for different countries in Asia present a challenge to further harmonisation.

AI – What’s the big picture?

This session delved into the broader implications of AI, distinguishing between machine learning and generative AI. AI’s potential to make less skilled workers more efficient was discussed, with demonstrations of tools like ChatGPT and Microsoft Co-pilot showcasing immediate benefits.

However, the conversation also touched on the risks of over-reliance on AI, likening it to a teenager – useful but not yet ready for complete control!

The economic potential of AI is vast, with projections of adding $2.6 to $4.4 trillion to the global economy. A study from MIT highlighted a 25% increase in task completion and a 40% improvement in accuracy due to AI, marking it as the biggest efficiency gain since the steam engine.

We wanted to spotlight one final, very thought-provoking panel in which Michael Buzza of Northern Trust discussed the slow adoption of digital assets, and how less than 20% of banks are prioritising them due to concerns over liquidity disruption.

The session underscored the need for interoperable ecosystems and cautious regulatory environments to foster growth without disadvantaging markets lacking proper infrastructure. Despite the hurdles, there is optimism as 2/3 of the audience said their banks have programs in place to focus on standardisation.

Attending The Network Forum provided Taskize with invaluable insights and opportunities to demonstrate the evolution of our platform to clients and partner colleagues. We are already looking forward to next year’s event in Madrid…