Outsourcing

A practitioner’s handbook to outsourcing with Taskize

Outsourcing back-office operations has been a growing trend over recent years, driven by cost, regulatory pressure, the need to create capacity in ope

The financial industry is evolving, with many institutions retiring legacy application infrastructure in favour of best-of-breed cloud solutions.

These new capabilities need to seamlessly connect to their clients’ Operations teams, and often also their clients’ counterparties. Taskize provides the answer, enabling any Fintech to easily exchange workflow with over 300 financial services firms, speeding value delivery to clients, and enabling the Fintech to concentrate on its core service.

Future is cloud-based, and it is now

Financial institutions are now “cloud-first”, as we learned from leadership at our largest clients. COVID-19 and the rapid deployment of cloud services at scale to support remote working has accelerated the transition. It proved in extremis that cloud was up to the task, even revealing that traditional IT was in many ways inferior.

Companies are beginning to deploy their preferred choice of SaaS products and systems in each category. There is an unmet need to connect these different systems together to increase the industry’s capability to work together in a structured way.

Introducing the work-exchange

No firm wants dozens of different connections to manage operations workflows across different counterparties.

What the industry needs, in essence, is a work-exchange. Like a stock-exchange, where a broker places an order on the exchange and the fulfilled order comes back into the broker’s order management system, a work-exchange allows a company to send out work to a counterparty and have it sent back completed, and flow this into their chosen internal workflow solution.

Taskize is the work-exchange, providing a single connection for workflow with the industry, thereby solving the main limitation of current workflow applications, which is that they only handle internal operations.

Firms can leverage the institutional knowledge embedded in their chosen internal workflow system, and connect with Taskize to share work and related data efficiently with their counterparties.

Taskize is uniquely positioned to be the work-exchange the industry needs, with a world-class pedigree in open connectivity. Taskize founder, John O’Hara, created AMQP – an open-source protocol which today drives messaging across the financial sector and used in products from Amazon, IBM, Microsoft, and Tesla. Taskize builds on that foundation of open innovation.

Standardising workflows

A whole range of benefits flow out of a standardised, connected industry. We know this from Straight Through Processing (STP) and continuing efforts to perfect this by the industry. But we also need to industrialise operations workflows between people.

Once financial firms have a standardised way of accessing operations teams across the industry, it becomes much easier to standardise particular processes across counterparties. As an example of this, Euroclear is using Taskize to standardise Buy-In Trade Reporting under CSDR across its CSDs.

Another key benefit of the connected industry is the management information that it can provide. Through Taskize, operations managers can see where the most counterparty fails arise, how efficient each counterparty is at resolving problems and where members of staff are struggling to meet internal performance standards. They can confidently direct their workforce to where the problems really are and delight their clients.

Navigating counterparties’ complex operational structures also becomes easy. Through Taskize Smart Directory™ you can be connected to the right individual at the right counterparty within 60 seconds, without knowing any details of that counterparty’s organisational structure, and without revealing details of your own organisation.

Taskize Smart Directory can be utilised regardless of whether a company uses Taskize’s workflow web application or connects their internal tools through the Taskize API.

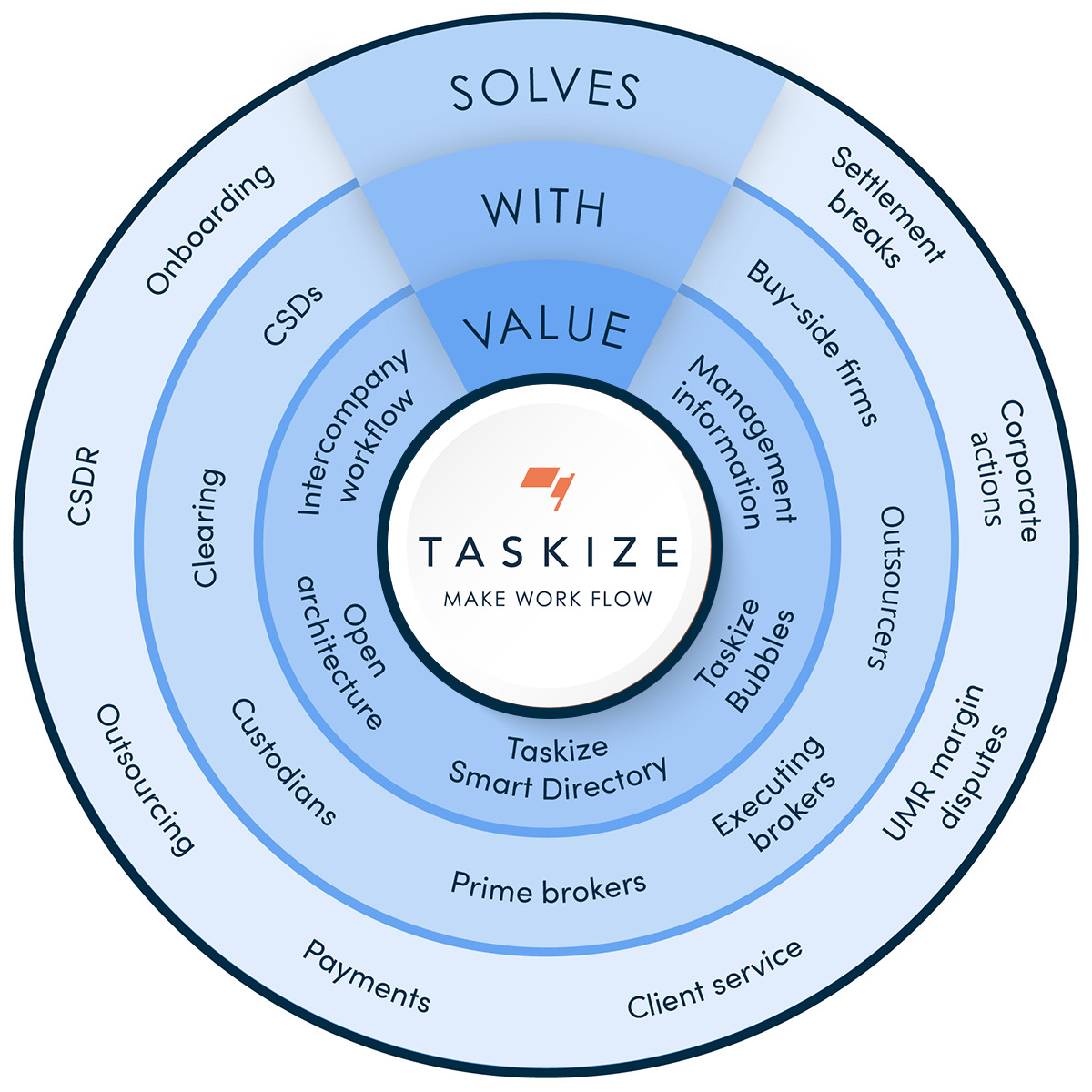

The diagram to the right gives an overview of the Taskize platform. The outer circle shows some of the important operational issues that Taskize solves for. These include streamlining the reconciliation of settlement disputes and allowing firms to resolve client queries more effectively than by phone or email.

The middle circle shows whom Taskize users work with to solve these problems. For example, Taskize offers clients a way to transparently move client requests to one or more outsource service providers (OSP), and gain oversight of their activity, whether to manage specific risks or to ensure the OSP is continually meeting key performance and success indicators across a range of services.

The inner circle shows the value Taskize delivers, which allows the industry to work together more effectively. This includes the Taskize Smart Directory, which we have already touched upon, and Taskize Bubbles, a secure environment where information can be shared and worked on in complete security.

A proven foundation

Taskize has delivered a proven foundation for the unique workflows of the financial services industry.

If you are trying to connect from your cloud-based workflow system to a counterparty, or have your counterparties connect to you, if you are trying to navigate an increasingly complex industry, or if you simply need joined-up management information across all your operational activities, Taskize can help.

If you would like to learn more about how Taskize can help your organisation, request a demo or meeting here.