Insights

Persuading an industry as conservative and risk-averse as financial services to adopt even incremental improvement is a challenge. Change is a four-letter word in the back office. However, relatively recent explorations of Nudge Theory may offer a way forward.

An example of changing entrenched behaviours can be found in the widespread placement of easy-to-use defibrillators in public spaces to treat people suffering a cardiac arrest. Science tells us that rapid intervention is critical to helping someone suffering from a heart attack. Initially, the behaviour within health services was to run paramedic teams and position fast response units to reach population centres quickly in the event of an emergency call. Health authorities and professionals believed this would allow the patient to be stabilised quickly, so it could then be transferred to a hospital in time to be treated successfully.

However, delays were still too long. What if patients could be treated immediately? With advances in technology defibrillators could now be placed in public areas – but who would use them? The answer turned out to be the public, even if it were by a person without medical knowledge. This insight led to the development of defibrillators which could be used correctly by members of the public with basic or no first-aid knowledge. The next step was to encourage the public not to be bystanders but to help in the event of an emergency.

Here, the devices were made easy, non-intimidating, and familiar, like existing help or fire points. Using the nudge principles of making it easy to do the right thing, setting sensible defaults, and social proofing the encouragement of the public to act.

How does any of this relate to financial services?

At the annual Investment Managers Operations Symposium (IMOS) in Bangalore, which was attended by more than a hundred industry leaders, we were reminded that OTC derivatives remain attractive to managers of active funds. Unfortunately, these OTC derivatives are also a source of a large number of operational exceptions. Under current regulations, the costs for OTC uncleared derivatives are higher than for OTC cleared, partly due to Variation Margin and Initial Margin requirements (see Mark Henrard’s blog at OpenGamma). Hence, the impact of operational issues in the bi-lateral clearing between organisations can be more severe on the liquidity requirements of the participants, especially for the buy-side.

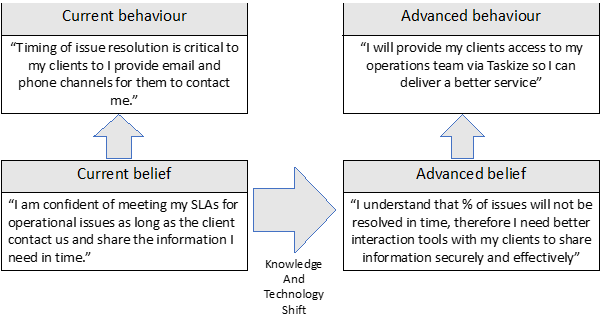

The financial industry realises that the time is taken for fails and exceptions to get to a “hospital” to be fixed, is precious. Financial institutions, as in medicine, are aware of the importance of acting quickly and accurately to resolve their clients’ issues. They are confident to be able to solve these issues successfully if they have the information required promptly. However, as technology and industry change, there is a recognition that with the current approach a certain percentage of the operational exceptions affecting clients cannot be solved within the appropriate time-frames, with the risks that this implies.

As a consequence, mature financial institutions have begun to nudge their counterparties towards better ways of working by making it easy to do the right thing. Some are providing access to their operational teams to their clients via Taskize to accelerate the resolution of problems between banks and industry participants.

The ability to easily track and solve operational issues securely across company boundaries, and away from phone and email, is the shift that Taskize is already witnessing with its clients.

These shifts take place gradually until they become commonplace and it is difficult to remember a time when the new behaviour did not exist. Behaviours that improve the experience that clients receive from their providers become a demanded new normal, benefiting all parties. But on the journey to the future, a well-placed nudge can provide immediate benefit across the community.

By Ricardo Sanchez at Taskize.