Network managers – three key trends for 2H25

A quiet revolution is sweeping through network management, with T+1 becoming the new global securities settlement standard, Artificial Intelligence (AI) transforming due diligence processes, and all whilst the industry is trying to navigate unprecedented country risks.

Taskize's James Pike looks at the top three trends shaping network management across the second half of 2025.

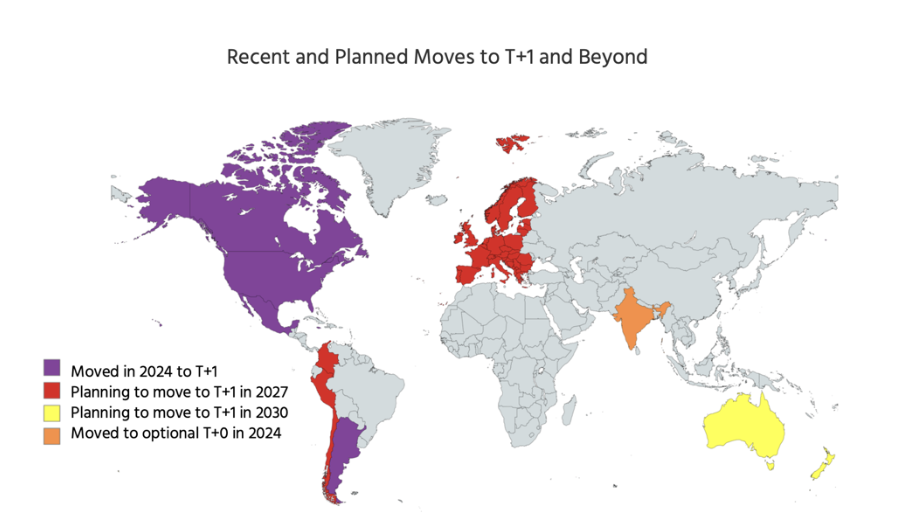

1. Network managers start preparing for T+1

More markets are moving to T+1, with Europe due to go live on October 11, 2027.

As T+1’s momentum accelerates across the continent, network managers are demanding proof from their sub-custodians and Financial Market Infrastructures (FMIs), such as CSDs and CCPs, that their T+1 plans are firmly on track. This comes after a number of network managers recently voiced their displeasure about the disappointing levels of T+1 readiness at certain intermediaries.

Some network managers believe this lack of urgency, particularly in Europe, is because the North American transition was relatively frictionless. While settlement fails did not surge in North America post-T+1, there were teething issues, particularly with FX and fund settlements.

However, T+1’s journey in Europe faces a sterner test than in North America.

This is because the EU is an incredibly diverse and complex market, and home to a vast number of FMIs. Unlike the US, where trades are settled and often cleared through one entity, the DTCC, the EU has multiple CSDs and even more CCPs, due to the nature of its capital markets.

EU members will often have their own national CSDs, and in some cases, there may be multiple CCPs within the same market – each supporting different asset classes. On account of this cross-border fragmentation, T+1’s implementation in Europe is going to be much harder than North America’s.

The costs of fails are non-trivial.

According to Target2Securities (T2S) data, monthly cash penalties for late matching and settlement fails on the T2S platform averaged $70.43 million, and this is only going to get worse in a T+1 ecosystem, as firms will have less time to complete their post-trade processing activities.

Automation of legacy technology will be critical if firms are to avoid fails and costly penalties.

The UK and EU T+1 industry taskforces have recommended financial institutions follow a broadly similar T+1 playbook to what worked in North America. For firms impacted by the European transition, this means using the remainder of 2025 to establish a T+1 plan and budget, then pushing ahead with systems development in 2026, and finally testing in 2027.

Whilst global custodians, broker-dealers and other market participants need to upgrade their technology stacks ahead of T+1, network managers must also check that their sub-custodians and FMIs are doing the same on their side.

2. AI – A help or hindrance for network managers?

The AI hype-cycle has not left network managers untouched.

This comes as a 2025 Broadridge study of buy and sell-side firms revealed that 57% of respondents are using AI in their operations and processes, adding that 72% are making moderate to large investments into Generative AI, up from 40% in 2024. 1

At recent industry events, including The Network Forum (TNF), Sibos and Post-Trade 360, banks and brokers have repeatedly highlighted how they are integrating AI into their workstreams. Whilst some banks have imposed blanket bans on staff using AI altogether, others are being more flexible in their approach.

In the case of network managers, speakers at TNF in Madrid earlier this summer said Generative AI tools are being deployed to refine due diligence questionnaires (DDQs), analyse sub-custodian/FMI answers to DDQs, help write market reports/assessments or draft email communiques.

A number of the network teams leveraging Generative AI report they are seeing significant efficiency gains. This is underscored in the same Broadridge study, which noted that 68% of firms said the biggest impact of Generative AI would be on their employees’ productivity, followed by better reporting (51%) and reduced operational costs (50%). AI – when used in conjunction with query resolution tooling – is essential in improving operational processes.

Whilst the technology has benefits, network managers highlight that a human-in-the-loop is still required for quality control purposes when reviewing DDQ answers, especially as the technology is known to hallucinate.

If sub-custodians and FMIs are using AI, then network managers will also need convincing that their data controls and governance are in order. During TNF Madrid, 34% of people cited data quality issues – followed by control and governance on 24% - and regulation with 20% - as being the biggest barriers to AI adoption.

While not all network management teams are wholly comfortable with AI, the technology is only going to get more embedded in their operations over time.

3. Network teams tackle country risk and operational resilience

Country and geopolitical risk is – now more than ever – a key criterium for network managers during their market risk assessments and supplier due diligences.

Whereas before, network teams would benchmark a country based on its liquidity profile, FX repatriation risk, the availability of an independent custody model and the existence of a sensible regulatory framework, country risk now carries a much higher weighting in these reviews, given recent events in the Middle East and Ukraine.

During due diligences, network managers are increasingly probing sub-custodians not just on their operational resilience, but also their commitment to local markets where geopolitical risk may be at slightly elevated levels.

If circumstances deteriorate further in certain regions, some network managers may start thinking about activating their hot or warm network contingency plans.

It is not just geopolitics which is keeping network managers up at night.

With the EU’s Digital Operational Resilience Act (DORA) now in force, network teams want to know that their intermediaries can cope with black swan scenarios, such as power supply disruptions, cyber-attacks or climate related disasters.

As extreme events become more normalised, network managers will have to adapt their due diligences accordingly.

Through the adoption of collaboration platforms such as Taskize, firms can eliminate the need for email and other manual interventions. This allows them to consolidate multiple workstreams within their organisation, giving them aggregated views, better insights and end-to-end audit trails into their operations, whether it is dealing with T+1, embracing new technologies, or managing operational resilience.

You May Also Like

These Related Stories

Driving the future of investment ops: Taskize’s 5 key takeaways from InvestOps Europe 2025

Industry priorities for 2026: A checklist

No Comments Yet

Let us know what you think